In January 2022, WTW A&E released a survey of senior claim managers from twelve leading professional liability insurance carriers for architects and engineers in North America. The survey focused on emerging risks and claim trends in the design profession. This article is the first of a three-part series that will address the survey’s key findings and offer some insights and recommendations on what design firms can do to mitigate their risk of costly claims and client disputes. In this issue we will discuss social inflation and cyber liability. Future issues will discuss the impacts of climate change, Covid-19, contracts, the enhanced risks associated with certain project types and staffing concerns.

Frequency and Severity

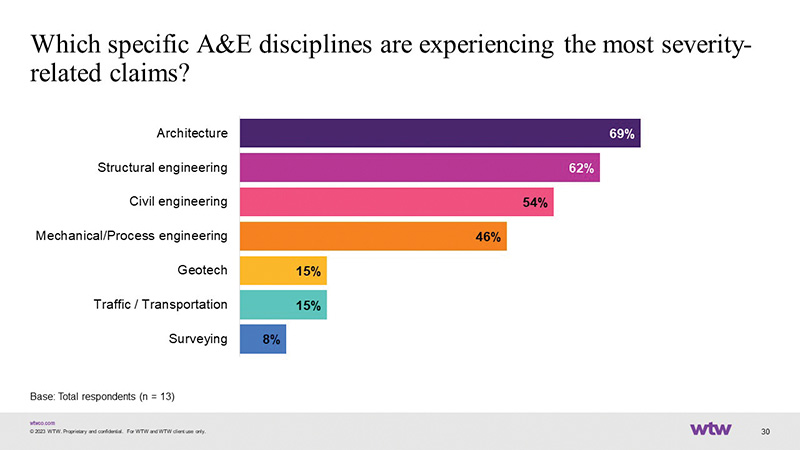

Underwriters use two metrics to evaluate a firm’s loss history. The first is frequency. How often do firms have claims? The second is severity. When those claims happen, how expensive are they? Almost half the carriers we surveyed said that they are seeing an increase in frequency of claims being made, and nearly three-quarters said that they are seeing an increase in the severity of those claims.

Severity is the more important of the two issues because the rating tools used by underwriters heavily factor in the loss ratio calculation, which compares the premium paid to the claim’s dollars incurred. The average claim usually costs around $75,000. A severity claim is typically classified as a claim that costs $250,000 or more. Severity hits the loss ratio and drives increased pricing.

One of the carriers that responded to the WTW A&E survey offered this comment concerning severity claims: “We’ve seen a steady and fairly extreme uptick in severity, primarily in our large firm’s segment arising from bodily injury-related losses.” (They define large firms as those generating over thirty million dollars in revenue annually.) “The single driving cause we have isolated is social inflation. And now we have supply chain interruptions, a looming recession, and economic inflation to contend with as well. For context, claims that five years ago may have been presented to us for $250,000 are now demanding a million or more for the loss. For example, $1 million claims in 2014 are now coming out of the starting blocks at around $3 million or more.”

In addition, claims are taking longer to settle. The consensus from our panel is that claims take two to three years to resolve on average, and outliers can take ten to fifteen years to resolve. This highlights the importance of good documentation practices so that you can be well-positioned to tell your story if required in the distant future.

Social Inflation

The first of our mega-trends is social inflation. That means that juries are giving out ever-increasing awards in their verdicts. One of the driving factors behind this trend goes back to a book that was published in 2009 by a plaintiff ’s attorney on “reptile theory.” This theory espouses that the plaintiff ’s counsel can maximize the verdict by tapping into the primitive self-preservation instincts of a juror by painting the defendant as dangerous to the juror and their community. Reptile theory espouses that you can get a bigger award if you can convince the jury that the case is not just about providing justice for the defendant but also safeguarding their family and community. This tactic has been used fairly successfully, and we see the result in verdict awards that are increasing much faster than the rate of inflation.

Another trend driving increasing litigation expense is litigation financing, where a third party, unrelated to the lawsuit, provides capital to the plaintiff involved in litigation in return for a portion of any financial recovery from the lawsuit.

We have seen a rash of bodily injury claims involving engineering firms and construction and traffic accidents in work zones. Right or wrong, the engineer is often dragged into these lawsuits. The engineer is typically not negligent in most of the cases that we’ve seen. However, you often have a very sympathetic plaintiff, and the state usually has sovereign immunity.

Another carrier that responded to the WTW A&E survey commented: “We have identified firm profiles and services that we feel are most exposed to severity claims. Most are large civil firms with construction management or site observation services working on large infrastructure projects, many of which are design-build delivery and no longer covered under project-specific policies. This isn’t the extent of where we are seeing severity claims, but these are the risks where we are finding we can’t really get our arms around the exposure even with firms who are well risk-managed and have good loss histories.”

The defensive strategy is to hit the job site safety exposure head-on and hard. The first step is to insert a requirement in the design professional’s contract that the contractor is solely responsible for job site safety. This should be non-controversial. The second step is to request Additional Insured status for design professionals on the contractor’s Commercial General Liability policy. The contractor traditionally manages the job site safety exposure, and part of managing that exposure includes ensuring that exposure. The third step in managing the job site safety exposure is to live within the contract terms and not assume responsibility for means and methods by virtue of our conduct on the job site. The classic example would be telling the contractor how to do his job. It can sneak up on you.

Sometimes a contractor will run into a problem and ask the design professional to show him how to fix it. It could be getting involved in the design of temporary structures or advising on job site safety. For that to happen, our contract must say that we are not responsible for job site safety, and our conduct must conform to the contract. We want to train our staff regarding our construction administration responsibilities and avoid documenting safety concerns because, if an engineer is sued for a job site injury, the only way to get out of that case without paying money is to file a successful Motion for Summary Judgement. And the standard for summary judgment is high – there must be no material question of fact.

We want to back this up with a request to be named as an additional insured on the contractor’s general liability policy. We need to require that in our agreement with the owner so that the owner will make it a term in the general conditions of the construction contract. The best time to ask for Additional Insured status is when the contractor is bidding on the job and is incentivized to cooperate. Thousands of insurance companies provide general liability coverage, and the top-tier carriers can provide Additional Insured status. If a contractor cannot provide Additional Insured status, they likely chose the lowest cost provider as their insurance partner. We would consider this a negative factor when evaluating that contractor’s capabilities.

There are two very important things to include with the contract in order to comply with the requirements of modern Additional Insured endorsements. The first is that the additional insured status provided will be on a primary and non-contributory basis. This means that the contractor’s insurance comes first and does not seek contributions from the design professional’s insurance. The second thing is that we need to specify what limits are available to the additional insured. I would recommend the full limits available to the contractor. But suppose we don’t say how much insurance is available to the additional insured. In that case, the carrier can take the position that there is no coverage for the additional insured because you did not specify how much was required.

The owner is getting named as an additional insured on that contractor’s GL policy. And that’s because that’s where the insurance belongs – with that party that can manage that risk. Even though we hear that contractors frequently push back against adding design professionals to their policies, we find that some of our professional design clients are actually quite successful in getting added as additionally insured to the GC’s policy. This is often at little or no additional cost to that contractor.

Cyber Liability

The cyber liability insurance market has become a challenging market due to the increasing frequency and severity of cyber-related claims. Ransomware has become the number one threat, as virtually any business can be targeted, not just those with troves of personally identifiable information. This has resulted in a great deal of underwriting scrutiny around cyber. An applicant firm needs to have very specific controls in place, including multi-factor authentication (MFA) and staff education plans to combat social engineering for underwriters even to consider offering you insurance. A cyber liability application will give you a list of defensive measures to consider. It’s also very important for firms to have an incident response plan in place to know what to do in the event of a cyber-attack. These attacks often come at a very inopportune time, such as over a weekend or a holiday. The best practice is to identify all the stakeholders within your business that will need to respond and take specific action in the event of a cyber-attack so that they can be quickly notified.