Engineering companies nationwide face labor constraints for experienced professionals to deliver work, continued supply chain disruptions, and construction labor and materials shortages caused by the Covid-19 pandemic. Moreover, economic conditions grow more challenging with elevated inflation, higher interest rates, and concerns that the U.S. economy is on the brink of a recession. Yet the top 10 publicly traded A/E/C companies are experiencing increased revenue through organic growth and expect more growth in 2023, although some do maintain their caution for the year ahead. Their strategies provide insights for companies of all sizes.

The Covid-19 pandemic placed commercial real estate at the epicenter of the crisis, disrupting property cash flows. This had immediate effects across all property types, particularly for office buildings and convention centers. The office market is forecasted to stay relatively flat. Although convention center use is still below pre-Covid levels, the volume has picked up in 2022, and cancellation rates are falling.

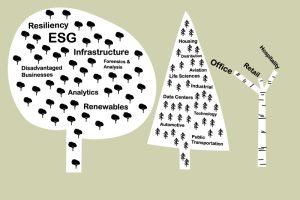

While the commercial market has not rebounded to pre-Covid levels, the technology sector is poised for continued growth. Economists expect their percentage of total GDP will double from 5 to 10 percent by 2030. This will demand new data centers, industrial manufacturing, and advanced technology manufacturing spaces. The industrial market continues to see strong long-term fundamentals across the U.S., as does the multi-family market. The Florida and Southwest markets are generally expected to outperform the nation. Retail e-commerce is predicted to increase by more than 50% towards 2023, requiring distribution centers and efficient transportation. Health and life sciences, automotive & technology, public transportation, and aviation will also thrive.

The ESG (Environment/Social Responsibility and Governance) policies of capital sources and large corporations increasingly drive opportunities for the A|E|C industry, such as in energy efficiency, renewable electricity, direct emissions abatement, carbon removal, and clean energy. They also open new markets to disadvantaged businesses. The global environmental remediation market is expected to experience a 7.5% compound annual growth rate between 2020 and 2027, an uptick to $100B. The green technology and sustainability market should rise by 27%, up to $29B between 2019 and 2024. The renewable energy market is expected to require $125 trillion in investment over the next 30 years, including electrical grids.

Civil infrastructure renewal will increase. Remediation of PFAS (per- and polyfluoroalkyl substances) in water supplies is propelling state and federal regulations and funding. The drinking water remediation technology spend is forecasted at $6.15B for this decade. Other construction growth areas are nuclear energy and waste management. Protecting coastal communities (the U.S. alone will require $400B in the next twenty years) will become an established market. Property damage appraisal, structural and civil forensics, and environmental consulting will also be needed to recover from the increasingly pronounced effects of climate change and extreme weather events.

Federally funded programs provide government, nonprofit, and private sector opportunities. The $114B Infrastructure Investment and Jobs Act passed in 2021; notices of funding opportunities are accelerating. The expected funding will most meaningfully benefit U.S. markets from fiscal 2023 through the next 5 to 10 years. The July 2022 Chips and Science Act provides $52B to support semiconductor chip manufacturing, including $39 billion for plant construction. The August 2022 Inflation Reduction Act brings another $50B, including $5B for programs that accelerate the construction industry’s shift toward green building materials and $4B to improve resiliency in affordable housing, such as funds for low-carbon materials. It allows FEMA’s Building Materials program to offer financial assistance for low-carbon materials and net-zero energy projects.

Recommendations

Wei Li, the Global Chief Investment Strategist for BlackRock, has stated that the themes for planning are “Back to a volatile future … Number one, bracing for volatility. Number two, living with inflation, and number three, positioning for net zero.” Consider these recommendations as you do your business planning for the year:

- Keep adequate reserves.

- Maintain emphasis on your best clients. For example, they may be responding to economic conditions with their workforce adaptations, or they could be planning to take advantage of climate and resilience loans and tax credits.

- Focus on opportunities to add digital analytics or shift into climate-related industries.

- Diversify your portfolio and identify strategic partners for key markets or to enter new markets.

- Create nimble teams to manage smaller capital construction programs.

- Continue to position for alternative project deliveries, like design-build, and services that have some vitality should a recession take hold, such as studies, or work in less volatile market sectors, like infrastructure.

- Invest in innovation.

- Develop your staff’s skills in client management and service.

We are living in an unpredictable world, and anything can arise. We recommend that companies perform a risk analysis and evaluate conditions for success as part of their planning process. At the same time, be prepared to pivot if the landscape changes.■