The economic downturn caused by the Covid-19 pandemic has affected design and construction firms around the United States, whether by stopping or slowing projects, triggering overnight switches from normal business operations to working from home, or its tolls on personal, physical, and emotional health. As the pandemic wears on, businesses are finding ways to overcome these setbacks. Yet, most experts expect that real recovery may not take place until 2022. This article points out strategies that can help your firm be resilient over the near term and positioned for continued financial success.

Where We Are

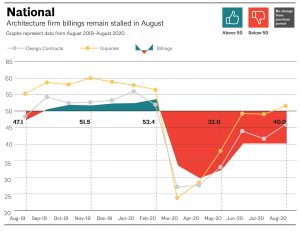

Since the Covid-19 pandemic took hold in March of this year, the national economy fell 31.7% (on an annualized basis) in the second quarter of 2020, the worst drop ever recorded by the U.S. Department of Commerce’s Bureau of Economic Analysis. This was preceded by a 5% contraction in the national gross domestic product in the first quarter of 2020. Many engineering and architecture companies have experienced hardship. The American Institute of Architects’ AIA Billings Index (ABI), considered an important economic indicator for all nonresidential construction activity, including multi-family, for the next nine to 12 months, plummeted from an overall score of 53.4 in February 2020 to 29.5 in April 2020. The AIA Billings Index looks at a month’s performance against the previous month, and a score of 50 indicates no change. Anything below 50 indicates a decreased outlook from the month before; over 50 shows growing demand. The August 2020 ABI, released in late September 2020, had an overall score of 40.0. The ABI has stood at 40.0 since June 2020.

Before implementing shelter-in-place measures, the majority of regions and market sectors were relatively healthy, with the strongest outlooks in the Southeast and the West. Most market sectors were in reasonably good shape, with some softness in higher education from the “baby bust,” the drop off in births during the 1990s, and its outsized inflation relative to the overall economy. Industrial and multi-family were particularly strong. In July 2020, Appleseed Strategy released results from its survey of 31 design and construction companies with offices in 12 states around the country. Compared to the months immediately before the shelter-in-place measures began, two-thirds of the respondents had experienced some drop off in their normal billings and projections as of late June 2020. While 30% of respondents had decreases in billings of 20% or less, 10% of the respondents had their billings decrease by over 60%. Firms experiencing greater drop-offs were more likely to be located in the Northeast. All survey respondents were concerned about their pipeline projects, with 67% of the companies facing decreasing projections, and an overall 42% projected decreases of 20% or more.

The respondents expressed uncertainty in their pipelines just one or two months out, in contrast to the more traditional reliability of these numbers for three to six months into the future.

Outlook – Uneven Terrain

Geographic regions and market sectors continue to be unevenly affected by the pandemic. The Southeast and West show some improvements, primarily driven by the continued long-term population shift to those regions. Much of the Midwest is not densely populated, which has reduced the immediate effects of the pandemic. The Northeast, whose economic indicators lagged behind the West and Southeast before the spread of Covid-19, was hardest hit in the early months of the pandemic and, compared to other regions, is more built out. Commercial owners across the country are reassessing their real estate plans, especially in tourism, hospitality, retail, and commercial office. Many government agencies and institutions are also in flux, whether from reduced funding and donations to capital campaigns or by the closure of in-person education and fears of exposure at healthcare facilities.

There are pockets of more robust markets. The Federal Government can choose to self-fund its projects and assist state and local governments. Generally, Federal agencies have continued work or are “kicking the tires” with feasibility studies. Many are planning for future work, particularly through IDIQs (Indefinite Delivery, Indefinite Quantity solicitations, also known as as-needed services contracts), which continue to be advertised. Grocery stores, drugstores, warehouses, and distribution centers are busy. Commercial and institutional real estate owners are looking at repurposing their holdings, although this work is often limited to feasibility and pricing studies. New and renovated housing is in demand, often outside of metropolitan centers. Owners across all markets are trying to use this time of decreased occupancy for needed repairs like deferred maintenance and seismic upgrades, with the hope that construction prices will fall as the pandemic wears on. However, a correction in construction pricing is not likely to take place until 2021, because most builders have contracts in place for materials and with subcontractors. Any lowering of construction costs would happen once the subcontractor and vendor pipelines drop. In regions like the San Francisco Bay Area, many builders have solid pipelines into 2022.

What You Can Do

- Keep in touch with your current, past, and prospective clients. This is fundamental at any time, but even more critical now. Show interest in what they are experiencing and find ways to offer help. Consider conducting surveys or holding roundtables to provide them with information they can use.

- At the same time, take an objective look at your client list, and evaluate your profitability by client, sector, service offering, and similar metrics. Pay special attention to where you have greater than 20% of your revenue from a single client, market sector, or service. These are areas where companies are in most danger of experiencing hardship if something unexpected happens. Diversify as much as you can.

- Reassess your business plan. A downturn is a great period to test out new models. Necessity is the mother of invention. Consider new service offerings and pricing structures. It may be time to be even bolder, through strategic hires, alliances, and acquisitions.

- Watch your competitors. They are watching you. There is an old adage in business development: your best client is your rival’s best prospect. Beyond the need to keep on your toes, your competitors may be launching new business models or pricing structures. Talented staff will also be coming on the market; keeping an eye on your competitors may give you the chance to get new resources in areas that will make you more economically resilient.

- Business development accountability (and training) for everyone! A strong business nurtures its whole staff to participate in business development on some level, whether by acting as a company ambassador or by keeping an eye out for opportunities to cross- or up-sell services. Remember that your key contacts may move on to new companies or retire, and your next client may be more receptive to others on your team.

Recommendations

- Take advantage of existing federal, state, and local government assistance programs, such as grants and low-interest loans. Watch for new programs and changes to those already in place. Because 2020 is an election year, more government assistance will be a top priority, whether through grants, loans, or tax relief. Existing programs have already been modified to facilitate their use, and further changes are very possible.

- Like it or not, any recession opens the profession up to disruptive influences. While brief lulls in work may be time to address nonbillable projects that have not received attention, downturns merit a look at where the market is headed and, consequently, strategic adjustments. Recessions are often when new businesses are launched, and these new competitors are likely to offer more aggressive risk/reward propositions. This is the time to look objectively at your business and consider refocusing or retraining staff, as well as making strategic hires, alliances, acquisitions, or mergers.

- Your clients are also evaluating what they can do to keep themselves financially successful. They are likely to be more open to new ideas, especially when looking to prove their worth to their own bosses. For instance, while many well-known retail brands and shopping center owners have been devastated by the pandemic, Amazon is buying former retail spaces to retrofit for local distribution. Across all regions and markets, owners are evaluating how to make the best use of what they have as they respond to economic disruptions. Structural engineers may find it advantageous to contact owners directly about offering targeted consultation bypassing the more expensive, full team approach.

- While most experts agree that people have short memories and that many modifications wrought by the pandemic will fade away once we are past its problems, it is also likely to spur longer-term physical changes to building stock. An obvious one many companies face: how much real estate do we need now that we are used to working from home at least part of the time? In Appleseed Strategy’s Summer 2020 survey, 73% of respondents were contemplating reducing their office space and seeking rent reductions and forbearance. Anecdotal evidence points to many companies maintaining work from home policies through the end of 2020 and beyond.

Conclusions

Whether you are experiencing little-to-no change in your business, or are in hardship, use this period to evaluate how you can make your company more resilient and set for future success. Research is essential. Look at what has made you successful, or not, and how likely the future economy will support your business model. Do the math. Talk to people – clients, prospects, allies, competitors, and especially your staff. Your financial success depends on an open mind and a clear-eyed assessment of both your company’s health and a range of possible future market conditions.■

This article is based on findings from Appleseed Strategy’s Summer 2020 financial and economic outlook survey. It has been updated with new economic data from the AIA Billings Index and other sources.

References

American Institute of Architects, August 2020 AIA Billings Index, www.aia.org/pages/6330393-abi-august-2020-architecture-firm-billings

Appleseed Strategy, Financial and Economic Survey, June 2020, www.appleseedstrategy.com/post/financial-and-economic-outlook-findings-released

Trading Economics, United States GDP Growth Rate, https://tradingeconomics.com/united-states/gdp-growth

U.S. Department of Commerce, Bureau of Economic Analysis, Gross Domestic Product, 2nd Quarter 2020 (Second Estimate); Corporate Profits, 2nd Quarter 2020 (Preliminary Estimate), www.bea.gov/news/2020/gross-domestic-product-2nd-quarter-2020-second-estimate-corporate-profits-2nd-quarter